Peak Oil is the point at which the total world oil production reaches its high point and finally starts to decline… We at last have some pretty convincing data to indicate that world oil production probably peaked forever in the summer of 2008…

By Roger Baker / The Rag Blog / April 7, 2009

Has peak oil arrived yet, and how do we know when that happens?

Everyone has probably at least heard the term “peak oil” by now, but perhaps without understanding much about what that phrase means or implies. It is the point at which the total world oil production reaches its high point and finally starts to decline. This is something that almost all geologists have known was going to happen sooner or later. During the energy crisis of the 1970’s, Scientific American predicted that oil production was already going to have peaked by now. There are many good “peak oil” sites these days, but this primer from Energy Bulletin is as good as any place to learn the basics:

For those of us who have been warning of the economic implications of peak oil, we do have at last some pretty convincing data to indicate that world oil production probably peaked forever in the summer of 2008. For one thing, we know from the official OPEC and International Energy Agency data that there was a supply peak and decline about the same time as the price peaked in the summer of 2008. Go here and scroll down to the chart titled “Now it is beginning to look like world oil production is beginning to decline.” (Lots more good economic discussion at the same link.)

As a follow-up example, look at Tony Ericksen’s chart and the discussion on the Oil Drum, which is a leading and essential energy policy discussion website. Erickson’s conclusions were based on a combination of current production data together with knowledge of the new oil production projects scheduled to come on line. His conclusion of a peak in 2008 was supported by most of the Oil Drum’s staff of (pro bono) writers and researchers.

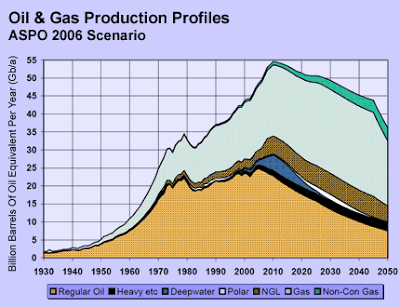

In addition, the highly respected ASPO International newsletter, edited by the Association for the Study of Peak Oil International director and geologist Dr. Colin Campbell, agrees with a 2008 world oil production peak. This fact is represented in the information on the second page of recent ASPO newsletters. Conventional oil produced from drilling on land probably peaked in 2005. The other more difficult and expensive sources like polar and deep-water and tar sand oil are now themselves falling short of being able to fill the widening oil demand shortfall left by the slow decline of the huge but aging fields that supply most of the world’s oil.

The argument for making the case that we have already hit world peak oil production is simple. First, oil production is known from the official data (see the second link above) to have reached a peak in July 2008 of about 86 million barrels per day. Since that time production declined, but not fast enough to match an even steeper drop in demand caused by the global economic crisis.

Up until July 2008, the bidding for the amount of oil globally available, including some element of speculation associated with a super-tight world market, raised the oil price to a historic high of $147 a barrel before the oil supply, oil price and the global economy collapsed, approximately together in their timing.

The July 2008 maximum production level was hugely expensive to reach. As one might imagine, vast amounts of capital were attracted in the past few years to the lucrative profits to be made in places like the Canadian tar sand fields from producing $100 plus oil.

Now that the price has collapsed to less than $50 a barrel, very many oil (and gas) drilling rigs previously devoted to trying to maintain maximum oil production have been shut down, or are falling into disrepair. Major oil projects around the world, including those in Saudi Arabia, have been canceled.

This collapse in current oil infrastructure investment due to a current lower price, together with the slow depletion of the biggest global super-giant fields, makes it very likely that oil production will now continue to contract. This no matter how much we might try to invest when the price shoots back towards $150 a barrel. Crash investments are unlikely to make much difference, assuming the capital is still available.

Since we don’t know the depth of what already amounts to a world depression, oil prices could remain at $50 a barrel for several years until a partial global economic recovery recreates a world market bumping up against the slowly declining ceiling in production once again. Nobody can accurately predict what will happen because the unpredictability of the current economic crisis makes the recovery of energy demand unpredictable. (See Heinberg in the upcoming Part 2 of this article.)

Oil is like nothing else in its role in the economy. Oil is the essential lifeblood of our modern fossil-fueled global economy, powering virtually all transportation, whether on land, or air, or sea. For this reason, the global economy is ultimately limited in its potential expansion by oil, and will for the foreseeable future. Just try to imagine the cost and difficulty of retrofitting the world’s jet aircraft to burn some other fuel than the kerosene-like jet fuel that they need now. We use a similar oil distillate fuel to launch rockets into space because nothing else can safely deliver more energy per pound when burned together with liquid oxygen. Less and more expensive oil means we will necessarily fly less and move fewer things around.

There are many important economic implications of our inconvenient industrial addiction, with most of them likely to be seen as unwelcome to conducting business as we have in the past. This is especially true when viewed in the context of a global capitalist economy.

By definition capitalism must always increase its production of goods, in order to earn interest on investment and remain economically healthy. Capitalism exists solely by virtue of its tendency to expand more strongly than competing modes of economic organization. When there is still lots of planet left to profitably exploit, capitalism tends to win out, at least in a Darwinian sense.

High oil prices act like a universal tax on all commerce. The price of oil is still poised to surge again whenever the desire to pay customers to move things around exceeds the amount of oil needed to accomplish that goal.

Not only is peak oil bad news to its users in a direct sense, but the evidence indicates this economic headwind, operating together with an unregulated and unwieldy mountain of poorly-secured global debt, probably initiated the economic collapse of 2008, as the Wall Street Journal indicates.

This is not the only source to implicate peak oil as a primary cause of the financial crisis. The crisis started to unwind in August 2007, beginning with the sub-prime mortgage problem, but it became acute in mid 2008. The following is from “Oil price and economic crash,” ASPO International, Feb. 1, 2009.

The German Financial Times features an article that links the record high oil prices of last July to the onset of the financial

No financial analyst managed to predict that 2008 would end in a recession. Generally the financial crisis has been described as the cause. However, it turns out that the initial suspicion was wrong. The chronology speaks against the fact that the September bankruptcy of Lehman Brothers crash caused the real economy. Key economic indicators were on descent weeks before Lehman Brothers collapsed.

In the United States, the number of new applications for unemployment benefits soared in the last week in July suddenly to recession levels – not mid-September. In August broke the upward trend in orders for U.S. companies, the orders fell within one month increased by four percent. Industrial production also fell abruptly in the month before the Lehman-crash – not afterwards. The same is true for America’s exports, which previously had boomed for months.

In the euro zone started in the mood indicators in June to time, with worsening in July. Even in China there was already weeks before Lehman signs of a serious economic setback. The crash of the summer of 2008 coincided with another global phenomenon: In June and July 2008, at the rise in oil prices, the first courses were almost twice as high as a year earlier. This also caused another shock as a result of the global: an inflation scare that led to just the interest rate in June shot up high expectations.

In agreement with the oil price theory, the sales of cars in the U.S. crashed at exactly the mid-July . With the oil price could also explain why no industry as a crisis like the car industry. In the euro zone fell to new registrations from June to July by 8.3 percent. The German car industry was almost 15 percent fewer orders than last year.

Oil production limits clearly initiated the bidding war that raised the world price to $147 a barrel before the oil price and the global economy collapsed approximately together. The ASPO newsletter has an oil price graph that strikingly shows the slow acceleration of oil price from 2000 to a soaring peak in summer of 2008. This chart can be seen as a visual representation of an irresistible economic force in direct collision with an immovable natural barrier.

Since liquid fuel production (most of which is oil) was running flat out at nearly 86 million barrels per day, any further bidding by an expanding economy, including some short term speculative forces, could only bid the price up still further, perhaps to $200 a barrel as some were anticipating in 2008.

At some point these very high fuel costs were bound to wreck the ability of the over-leveraged economy to expand and repay its debt. Cost-push inflation associated with the embedded cost of transportation was poised to diffuse throughout the economy within months of fuel price increases. Things just happened to hit the wall of financial reality when oil reached $147 per barrel.

This world fuel production level of 86 million barrels per day was a very expensive and difficult level of oil production to achieve and maintain. Now that the world oil price has collapsed to less than $50 a barrel, partly due to about a 4% reduction in yearly US oil demand, many oil and gas rigs have been forced to shut down.

This collapse in current investment together with slow depletion of the biggest global giant fields virtually assures that world oil production will now continue to contract. Since oil is the lifeblood of the modern world economy, powering virtually all transportation, the global economy will have to contract too, and probably for a long time to come.

There are many implications of peak oil. There are delayed effects, like the current economic crisis, but most of the results are likely to be seen as unwelcome. If things were bad when gasoline hit $4 a gallon last summer, what happens when it costs $10 a gallon?

[What to do about the current situation will be the focus of Part 2 of Roger Baker’s series, “The Reality of ‘Peak Oil.'”]

Add to that World population peaking about 2050 and what is going to happen:: Here is what I thing:: http://www.myqualitytime.net/2009/03/rats-in-cage.html

DO WE EXHAUST EARTHS RESOURCES YIELDING A MASS “DIE OFF” OF billions of people on this spherical Petri dish CALLED EARTH…

For those who want detailed and scholarly confirmation of the role of the 2008 oil shock on the global economy should see the Brookings paper by UC San Diego economist Dr. James Hamilton, which can be downloaded as a PDF file:

http://www.econbrowser.com/archives/2009/04/causes_of_the_o.html

April 02, 2009

Causes of the Oil Shock of 2007-08

“…But while the question of the possible contribution of speculators and the Fed is a very interesting one, it should not distract us from the broader fact: some degree of significant oil price appreciation during 2007-08 was an inevitable consequence of booming demand and stagnant production. It is worth emphasizing that this is fundamentally a long-run problem, which has been resolved rather spectacularly for the time being by a collapse in the world economy. However, the economic collapse will hopefully prove to be a short-run cure for the problem of excess energy demand. If growth in the newly industrialized countries resumes at its former pace, it would not be too many more years before we find ourselves back in the kind of calculus that was the driving factor behind the problem in the first place. Policy-makers would be wise to focus on real options for addressing those long-run challenges, rather than blame what happened last year entirely on a market aberration.”

http://www.econbrowser.com/archives/2009/04/consequences_of.html

“…In a follow-up on my earlier post, I’d now like to discuss the second part of my paper, Causes and Consequences of the Oil Shock of 2007-08, which I presented today at a conference at the Brookings Institution.

My paper concludes:

Eventually, the declines in income and house prices set mortgage delinquency rates beyond a threshold at which the overall solvency of the financial system itself came to be questioned, and the modest recession of 2007:Q4-2008:Q3 turned into a ferocious downturn in 2008:Q4. Whether we would have avoided those events had the economy not gone into recession, or instead would have merely postponed them, is a matter of conjecture. Regardless of how we answer that question, the evidence to me is persuasive that, had there been no oil shock, we would have described the U.S. economy in 2007:Q4-2008:Q3 as growing slowly, but not in a recession.”

I believe that much that has been quoted comes from industry sources that in turn leads to a credibility issue. It is in the industry’s interest to paint the bleakest picture possible. How else to squeeze a few more tax breaks and outright sources of funding?

That said, oil prices will likely head higher as soon as the economy begins to recover. Bear in mind that no hard evidence of a recovery exist at the present time. The banking crisis is nowhere near done with as will unfold in the months ahead.

On the other hand, prices will rise largely due to the energy companies cutting back on exploration and infrastructure. Great moves on their end but not so good for the consumer. Add to this political instability throughout the world, and yes, look to pay a premium for petrol in the years ahead.

Now, if our politicians could just act in the public interest rather than their own, we could get off the fossil fuel habits within ten years. By building a hundred nuclear power plants evenly spread throughout the country along with pushing affordable plug-in electric vehicles that performed adequately, fossil fuel requirements would drastically fall so as to be covered by domestic production.

Will I see such during my lifetime?

I doubt it after failure after repeated failure of government to lead over the past forty years…

Grumpy One in Austin