‘Once the recovery effort is well underway, it will be time to turn to prophylactic measures: reforming the system so that the crisis doesn’t happen again.’

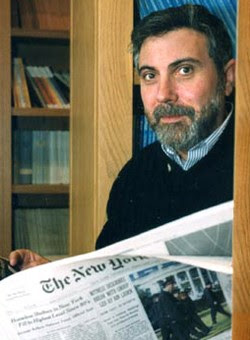

By Paul Krugman

The following article by educator, New York Times columnist and Nobel prize winning economist Paul Krugman appears in the Dec. 18, 2008 isssue of The New York Review of Books.

What the world needs right now is a rescue operation. The global credit system is in a state of paralysis, and a global slump is building momentum as I write this. Reform of the weaknesses that made this crisis possible is essential, but it can wait a little while. First, we need to deal with the clear and present danger. To do this, policymakers around the world need to do two things: get credit flowing again and prop up spending.

The first task is the harder of the two, but it must be done, and soon. Hardly a day goes by without news of some further disaster wreaked by the freezing up of credit. As I was writing this, for example, reports were coming in of the collapse of letters of credit, the key financing method for world trade. Suddenly, buyers of imports, especially in developing countries, can’t carry through on their deals, and ships are standing idle: the Baltic Dry Index, a widely used measure of shipping costs, has fallen 89 percent this year.

What lies behind the credit squeeze is the combination of reduced trust in and decimated capital at financial institutions. People and institutions, including the financial institutions, don’t want to deal with anyone unless they have substantial capital to back up their promises, yet the crisis has depleted capital across the board.

The obvious solution is to put in more capital. In fact, that’s a standard response in financial crises. In 1933 the Roosevelt administration used the Reconstruction Finance Corporation to recapitalize banks by buying preferred stock—stock that had priority over common stock in terms of its claims on profits. When Sweden experienced a financial crisis in the early 1990s, the government stepped in and provided the banks with additional capital equal to 4 percent of the country’s GDP—the equivalent of about $600 billion for the United States today—in return for a partial ownership. When Japan moved to rescue its banks in 1998, it purchased more than $500 billion in preferred stock, the equivalent relative to GDP of around a $2 trillion capital injection in the United States. In each case, the provision of capital helped restore the ability of banks to lend, and unfroze the credit markets.

A financial rescue along similar lines is now underway in the United States and other advanced economies, although it was late in coming, thanks in part to the ideological tilt of the Bush administration. At first, after the fall of Lehman Brothers, the Treasury Department proposed buying up $700 billion in troubled assets from banks and other financial institutions. Yet it was never clear how this was supposed to help the situation. (If the Treasury paid market value, it would do little to help the banks’ capital position, while if it paid above-market value it would stand accused of throwing taxpayers’ money away.) Never mind: after dithering for three weeks, the United States followed the lead already set, first by Britain and then by continental European countries, and turned the plan into a recapitalization scheme.

It seems doubtful, however, that this will be enough to turn things around, for at least three reasons. First, even if the full $700 billion is used for recapitalization (so far only a fraction has been committed), it will still be small, relative to GDP, compared with the Japanese bank bailout—and it’s arguable that the severity of the financial crisis in the United States and Europe now rivals that of Japan. Second, it’s still not clear how much of the bailout will reach the components of the shadow banking system—largely unregulated financial organizations including investment banks and hedge funds—that are at the core of the problem. Third, it’s not clear whether banks will be willing to lend out the funds, as opposed to sitting on them (a problem encountered by the New Deal seventy-five years ago).

My guess is that the recapitalization will eventually have to get bigger and broader, and that there will eventually have to be more assertion of government control—in effect, it will come closer to a full temporary nationalization of a significant part of the financial system. Just to be clear, this isn’t a long-term goal, a matter of seizing the economy’s commanding heights: finance should be reprivatized as soon as it’s safe to do so, just as Sweden put banking back in the private sector after its big bailout in the early Nineties. But for now the important thing is to loosen up credit by any means at hand, without getting tied up in ideological knots. Nothing could be worse than failing to do what’s necessary out of fear that acting to save the financial system is somehow “socialist.”

The same goes for another line of approach to resolving the credit crunch: getting the Federal Reserve, temporarily, into the business of lending directly to the nonfinancial sector. The Federal Reserve’s willingness to buy commercial paper is a major step in this direction, but more will probably be necessary.

All these actions should be coordinated with other advanced countries. The reason is the globalization of finance. Part of the payoff for US rescues of the financial system is that they help loosen up access to credit in Europe; part of the payoff to European rescue efforts is that they loosen up credit here. So everyone should be doing more or less the same thing; we’re all in this together.

And one more thing: the spread of the financial crisis to emerging markets makes a global rescue for developing countries part of the solution to the crisis. As with recapitalization, parts of this were already in place during the autumn: the International Monetary Fund was providing loans to countries with troubled economies like Ukraine, with less of the moralizing and demands for austerity that it engaged in during the Asian crisis of the 1990s. Meanwhile, the Fed provided swap lines to several emerging-market central banks, giving them the right to borrow dollars as needed. As with recapitalization, the efforts so far look as if they’re in the right direction but too small, so more will be needed.

Even if the rescue of the financial system starts to bring credit markets back to life, we’ll still face a global slump that’s gathering momentum. What should be done about that? The answer, almost surely, is good old Keynesian fiscal stimulus.

Now, the United States tried a fiscal stimulus in early 2008; both the Bush administration and congressional Democrats touted it as a plan to “jump-start” the economy. The actual results were, however, disappointing, for two reasons. First, the stimulus was too small, accounting for only about 1 percent of GDP. The next one should be much bigger, say, as much as 4 percent of GDP. Second, most of the money in the first package took the form of tax rebates, many of which were saved rather than spent. The next plan should focus on sustaining and expanding government spending—sustaining it by providing aid to state and local governments, expanding it with spending on roads, bridges, and other forms of infrastructure.

The usual objection to public spending as a form of economic stimulus is that it takes too long to get going—that by the time the boost to demand arrives, the slump is over. That doesn’t seem to be a major worry now, however: it’s very hard to see any quick economic recovery, unless some unexpected new bubble arises to replace the housing bubble. (A headline in the satirical newspaper The Onion captured the problem perfectly: “Recession-Plagued Nation Demands New Bubble to Invest In.”) As long as public spending is pushed along with reasonable speed, it should arrive in plenty of time to help—and it has two great advantages over tax breaks. On one side, the money would actually be spent; on the other, something of value (e.g., bridges that don’t fall down) would be created.

Some readers may object that providing a fiscal stimulus through public works spending is what Japan did in the 1990s—and it is. Even in Japan, however, public spending probably prevented a weak economy from plunging into an actual depression. There are, moreover, reasons to believe that stimulus through public spending would work better in the United States, if done promptly, than it did in Japan. For one thing, we aren’t yet stuck in the trap of deflationary expectations that Japan fell into after years of insufficiently forceful policies. And Japan waited far too long to recapitalize its banking system, a mistake we hopefully won’t repeat.

The point in all of this is to approach the current crisis in the spirit that we’ll do whatever it takes to turn things around; if what has been done so far isn’t enough, do more and do something different, until credit starts to flow and the real economy starts to recover.

And once the recovery effort is well underway, it will be time to turn to prophylactic measures: reforming the system so that the crisis doesn’t happen again.

Financial Reform

“We have magneto trouble,” said John Maynard Keynes at the start of the Great Depression: most of the economic engine was in good shape, but a crucial component, the financial system, wasn’t working. He also said this: “We have involved ourselves in a colossal muddle, having blundered in the control of a delicate machine, the working of which we do not understand.” Both statements are as true now as they were then.

How did this second great colossal muddle arise? In the aftermath of the Great Depression, we redesigned the machine so that we did understand it, well enough at any rate to avoid big disasters. Banks, the piece of the system that malfunctioned so badly in the 1930s, were placed under tight regulation and supported by a strong safety net. Meanwhile, international movements of capital, which played a disruptive role in the 1930s, were also limited. The financial system became a little boring but much safer.

Then things got interesting and dangerous again. Growing international capital flows set the stage for devastating currency crises in the 1990s and for a globalized financial crisis in 2008. The growth of the shadow banking system, without any corresponding extension of regulation, set the stage for latter-day bank runs on a massive scale. These runs involved frantic mouse clicks rather than frantic mobs outside locked bank doors, but they were no less devastating.

What we’re going to have to do, clearly, is relearn the lessons our grandfathers were taught by the Great Depression. I won’t try to lay out the details of a new regulatory regime, but the basic principle should be clear: anything that has to be rescued during a financial crisis, because it plays an essential role in the financial mechanism, should be regulated when there isn’t a crisis so that it doesn’t take excessive risks. Since the 1930s commercial banks have been required to have adequate capital, hold reserves of liquid assets that can be quickly converted into cash, and limit the types of investments they make, all in return for federal guarantees when things go wrong. Now that we’ve seen a wide range of non-bank institutions create what amounts to a banking crisis, comparable regulation has to be extended to a much larger part of the system.

We’re also going to have to think hard about how to deal with financial globalization. In the aftermath of the Asian crisis of the 1990s, there were some calls for long-term restrictions on international capital flows, not just temporary controls in times of crisis. For the most part these calls were rejected in favor of a strategy of building up large foreign exchange reserves that were supposed to stave off future crises. Now it seems that this strategy didn’t work. For countries like Brazil and Korea, it must seem like a nightmare: after all that they’ve done, they’re going through the 1990s crisis all over again. Exactly what form the next response should take isn’t clear, but financial globalization has definitely turned out to be even more dangerous than we realized.

The Power of Ideas

As readers may have gathered, I believe not only that we’re living in a new era of depression economics, but also that John Maynard Keynes—the economist who made sense of the Great Depression—is now more relevant than ever. Keynes concluded his masterwork, The General Theory of Employment, Interest and Money, with a famous disquisition on the importance of economic ideas: “Soon or late, it is ideas, not vested interests, which are dangerous for good or evil.”

We can argue about whether that’s always true, but in times like these, it definitely is. The quintessential economic sentence is supposed to be “There is no free lunch”; it says that there are limited resources, that to have more of one thing you must accept less of another, that there is no gain without pain. Depression economics, however, is the study of situations where there is a free lunch, if we can only figure out how to get our hands on it, because there are unemployed resources that could be put to work. The true scarcity in Keynes’s world—and ours—was therefore not of resources, or even of virtue, but of understanding.

We will not achieve the understanding we need, however, unless we are willing to think clearly about our problems and to follow those thoughts wherever they lead. Some people say that our economic problems are structural, with no quick cure available; but I believe that the only important structural obstacles to world prosperity are the obsolete doctrines that clutter the minds of men.

November 20, 2008

Copyright © 2009, 1999 by Paul Krugman

Source / The New York Review of Books

Thanks to Dr. S. R. Keister / The Rag Blog

Here is a pretty good explanation about why Krugman’s Keynesian remedy probably won’t work, with a snip from the source article:

http://blog.atimes.net/?p=246

“…Dis-saving is a demographic imperative — unless, of course, no-one retires. Something like that is bound to happen. That will keep labor costs low indefinitely, as long lines of senior citizens stand on streetcorners